Accounting Services for Small Businesses & Individuals

Experience You Can Trust

I specialize in providing accounting services tailored to help small businesses and individuals. My goal is to help you attain financial success through an array of comprehensive solutions.

My objective is to assist financial planning and optimize your well-being. My services include providing accurate and timely financial statements, bookkeeping, budgeting, payroll services, mid-size business controller outsourcing, tax planning and tax preparation, and financial analysis. Furthermore, I provide customized advice tailored specifically to each of your needs and goals.

I am committed to providing the highest-level professional service. I provide accurate financial statements while analyzing revenue/expense trends to optimize after-tax income maximization, all with the goal of helping you attain financial prosperity.

For your convenience, I can provide all services virtually or travel to meet you within the Savannah/Statesboro area. All consultations are provided by appointment only.

Income Tax Preparation Services

I offer extensive knowledge and expertise in the law, regulations, and compliance related to tax law for various business entities, personal taxation, estates, and trusts. By staying up-to-date on legislation that could impact you or your business, I can reduce what is owed and maximize deductions that can be claimed.

Let Magnolia ease the burden of tax filing by handling it for you. Our partnership guarantees accurate income tax filings!

One of the key advantages of working with me is personalized service. I take time to learn your financial situation and maximize the tax filing process.

I keep up-to-date with tax laws and regulations to tailor a strategy that will help you easily reach your financial goals. My customized approach ensures that each situation is addressed precisely and carefully – individuals and small businesses alike.

From filing basic returns to complex tax planning needs, I am here to assist. I am ready and available to address any of your tax preparation queries or address concerns that arise during this process. My efficient processes and attentive service guarantee accurate and timely filings, ensuring compliance and peace of mind.

One of the key advantages of working with me is personalized service. I take time to learn your financial situation and maximize the tax filing process.

I keep up-to-date with tax laws and regulations to tailor a strategy that will help you easily reach your financial goals. My customized approach ensures that each situation is addressed precisely and carefully – individuals and small businesses alike.

From filing basic returns to complex tax planning needs, I am here to assist. I am ready and available to address any of your tax preparation queries or address concerns that arise during this process. My efficient processes and attentive service guarantee accurate and timely filings, ensuring compliance and peace of mind.

Bookkeeping for Small Businesses

As a CPA specializing in small business bookkeeping, I understand the difficulties in managing your organization’s finances. I take a personalized approach tailored specifically for small businesses like yours. Let me handle all of your accounting needs, so you can focus on growing your business.

I offer accounting services tailored specifically for small businesses, meeting all accounting needs:

Maintain and manage the general ledger system to maintain accurate financial records while streamlining invoicing processes to charge customers on time and accurately.

Conduct an in-depth review of all general ledger entries, making necessary corrections and adjustments as required to ensure data accuracy. I will deliver straightforward financial reports which provide valuable insight into your business performance.

QuickBooks help from QuickBooks setup through training and ongoing support. My goal is to ensure the efficient use of this accounting software for you and your staff, making life simpler for all involved.

I will prepare all necessary business income tax returns, ensuring compliance and eliminating last-minute surprises or extensions. Regular clients can count on having their returns ready well ahead of the April 15th deadline.

Prepare for year-end tax planning and advice by taking advantage of year-round advice. I manage tax obligations proactively and avoid unpleasant surprises!

Maintain and manage the general ledger system to maintain accurate financial records while streamlining invoicing processes to charge customers on time and accurately.

Conduct an in-depth review of all general ledger entries, making necessary corrections and adjustments as required to ensure data accuracy. I will deliver straightforward financial reports which provide valuable insight into your business performance.

I provide complete payroll care for seamless payroll management. This includes running payroll and processing, handling payroll taxes, direct deposits, and reports.

QuickBooks help from QuickBooks setup through training and ongoing support. My goal is to ensure the efficient use of this accounting software for you and your staff, making life simpler for all involved.

I will prepare all necessary business income tax returns, ensuring compliance and eliminating last-minute surprises or extensions. Regular clients can count on having their returns ready well ahead of the April 15th deadline.

Prepare for year-end tax planning and advice by taking advantage of year-round advice. I manage tax obligations proactively and avoid unpleasant surprises!

Tax Planning

Filing taxes can be complex and unnerving. That is why proactive, accurate tax planning services are so crucial. I specialize in offering proactive strategies that protect and grow wealth.

Given your specific financial goals and circumstances, I design tailored tax planning strategies to maximize after-tax income and decrease taxes on investments and income streams. Through careful analysis, I provide recommendations that enable you to expand and protect assets while reducing tax burdens.

I offer tax refund estimates that allow for accurate forecasting of potential refunds you could be entitled to receive. By carefully reviewing your financial records and tax situation, I can provide you with an accurate forecast for informed financial decision-making.

Tax Planning

Filing taxes can be complex and unnerving. That is why proactive, accurate tax planning services are so crucial. I specialize in offering proactive strategies that protect and grow wealth.

Given your specific financial goals and circumstances, I design tailored tax planning strategies to maximize after-tax income and decrease taxes on investments and income streams. Through careful analysis, I provide recommendations that enable you to expand and protect assets while reducing tax burdens.

I offer tax refund estimates that allow for accurate forecasting of potential refunds you could be entitled to receive. By carefully reviewing your financial records and tax situation, I can provide you with an accurate forecast for informed financial decision-making.

Tax Preparation & Compliance Services

I aim to maximize deductions while minimizing audit risk for tax preparation services. Additionally, I remain up-to-date with new legislation which may impact you or your business. This knowledge covers business entities, personal taxation, estates, and trusts.

Through a proactive approach, I can keep abreast of changes to tax laws and regulations, understand their complexities, and ensure your returns are complied with. You can count on my in-depth understanding of the tax landscape to prepare accurate returns for you.

I provide customized tax strategies tailored to your unique situation to reduce what you owe the IRS. I aim to maximize your tax position, so more of your hard-earned money stays in your pockets.

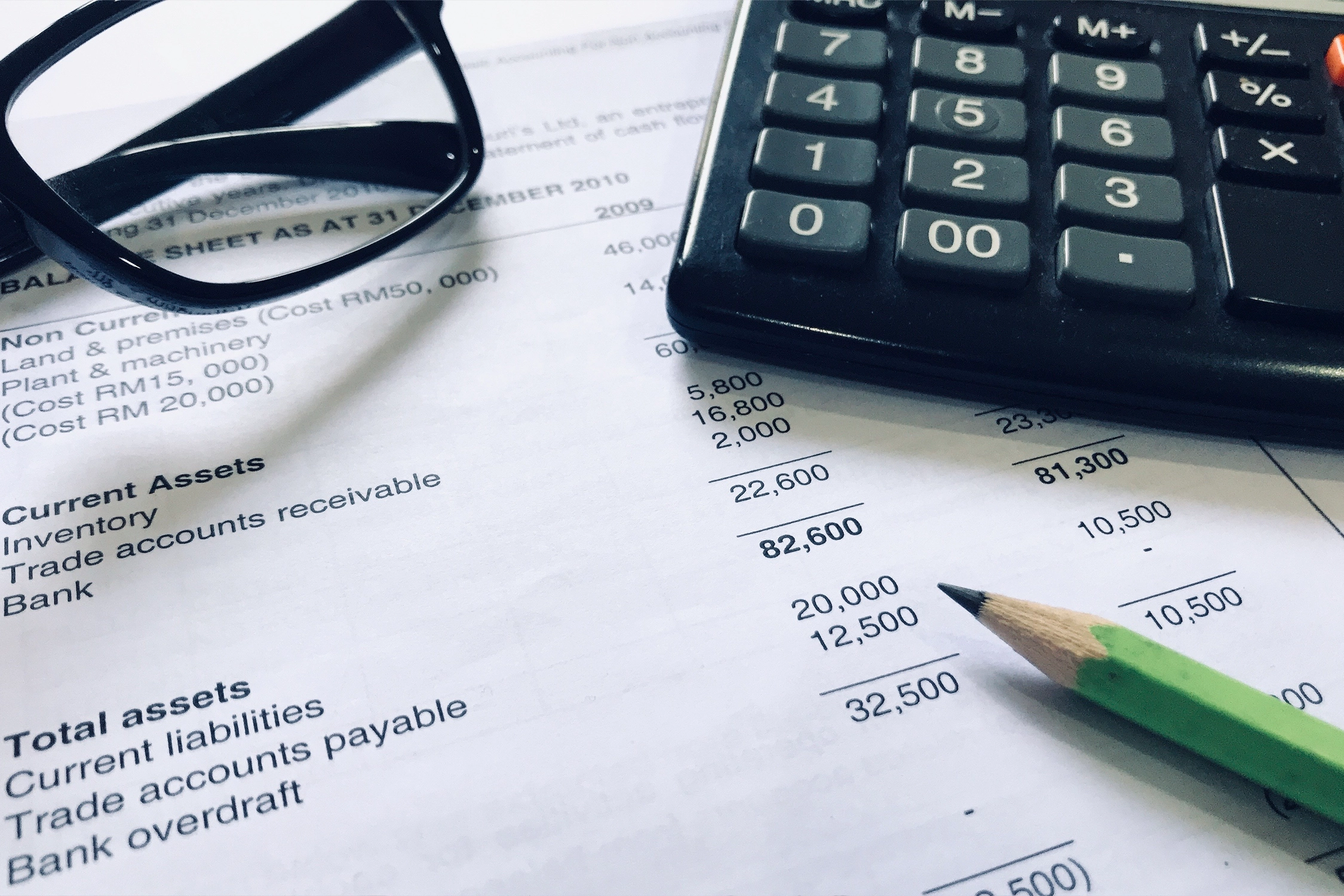

Financial Statement Preparation

I offer comprehensive Financial Statement Prep services to small businesses and individuals. By paying close attention to every detail, I ensure the accurate preparation of key financial documents like your income statement and balance sheet.

By analyzing your financial records, I provide valuable insights into your operating expenses, operating income, and gross profit to clarify your financial performance. My commitment is to provide reliable yet professional financial statements for internal decision-making or external reporting.

Payroll Services for Small Businesses

Magnolia Tax Consulting’s payroll services are tailored to simplify payroll processes for small businesses. Let me handle time-consuming tasks like calculating payroll, managing withholdings, and producing paychecks while complying with regulations. Plus, enjoy the ease of online payroll services such as electronic filing and direct deposit to ensure timely, accurate payroll processing. Thus, giving you peace of mind knowing your payroll will be managed accurately while saving valuable resources.

Payroll Services for Small Businesses

Magnolia Tax Consulting’s payroll services are tailored to simplify payroll processes for small businesses. Let me handle time-consuming tasks like calculating payroll, managing withholdings, and producing paychecks while complying with regulations. Plus, enjoy the ease of online payroll services such as electronic filing and direct deposit to ensure timely, accurate payroll processing. Thus, giving you peace of mind knowing your payroll will be managed accurately while saving valuable resources.